BMO POS Accounting System

- Receipt

- Invoice

- Delivery Order

- Quotation

- Purchase Order

- Inventory

- Profit & Lost

- Reports

RM 2999

FULL SET

BMO POS Invoicing Features

Features

- BMO POS Software

- BMO Accounting Software

Hardware

Free Accessories

(while stocks last)

- 80mmX27m Thermal Paper 10rolls

- 6 Months Cloud Subscription

- Open / Closed Sign

- Children Workbook

- 3 Years Online Support

Upgrades

- Full HD Touch Screen +RM550

- View Purchase with Purchase

Contact Us for Customization

Payment

- One Time Payment

- No Monthly Charges Without Cloud

Gifts

Pick 1 from below (subject to availability):

- Toys Cash Register

- Dessert Shop Toy

- Portable Drill 12V

** QR / E-Wallet Payment Terminal (Optional)

BMO POS Software Features

- Standard POS system features, you may visit our feature list for comprehensive features of our powerful POS System.

- For many customized features, you can always refer to our salesperson or found the description of the features on this web page.

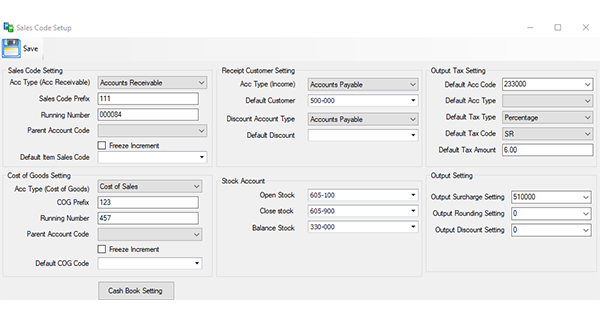

POS with accounting system:

BMO POS Accounting system comes with accounting software. All the transactions can be posted to accounting in real time and generate necessary reports. With Accounting software, you can generate multiple documents such as invoices, purchase orders, quotations, credit notes, etc. By integrating the invoicing capabilities into the POS system, businesses can streamline their document generation processes, maintain accurate financial records, and provide excellent customer service by efficiently managing invoices, receipts, quotes, and other relevant documents.

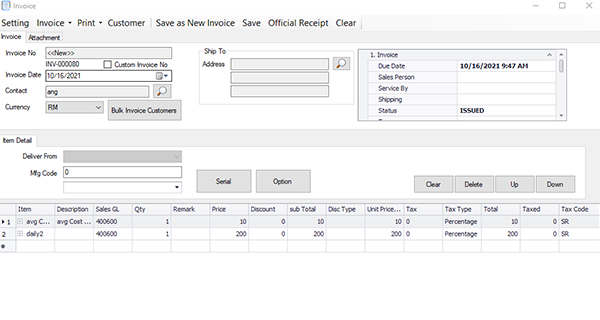

Invoices:

Invoices are essential documents that businesses generate to request payment from their customers. With a combined POS and invoicing system, invoices can be automatically generated based on the sales transactions recorded in the POS. The system can include details such as item descriptions, quantities, prices, taxes, discounts, and total amounts. These invoices can be customized with the company’s branding and sent to customers electronically or in print.

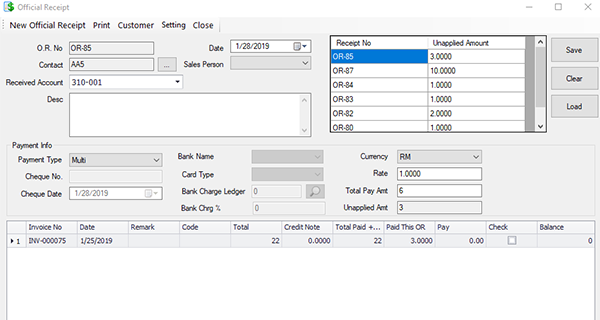

Receipts:

Receipts are generated for each individual sale or transaction and provide customers with proof of purchase. In a combined POS and invoicing system, receipts can be printed or emailed to customers. They typically include details such as the business name, transaction date, itemized list of purchased products or services, prices, taxes, and the payment method. Receipts can also serve as records for businesses to track their sales and reconcile with the invoiced amounts.

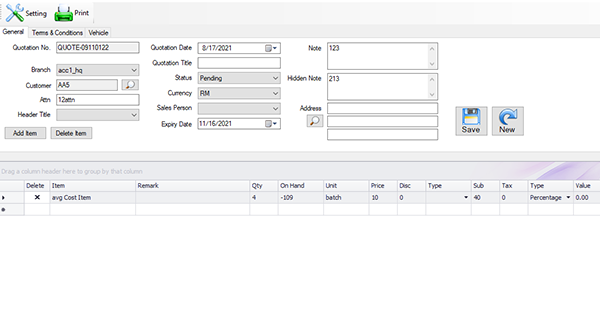

Quotation and Estimates:

Businesses often generate quotes or estimates for potential customers. These documents provide detailed pricing information for products or services and can be used as a basis for negotiation or as a formal proposal. In a BMO POS Accounting System, quotes and estimates can be created based on the inventory and pricing information available in the POS system, ensuring accuracy and consistency.

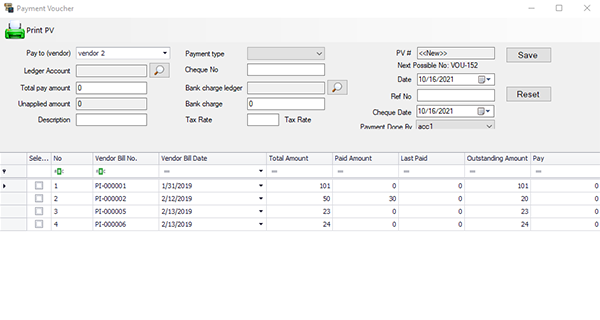

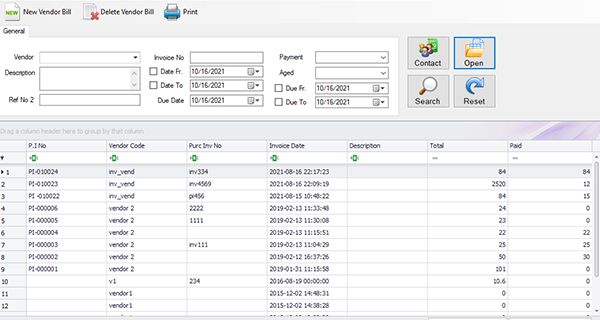

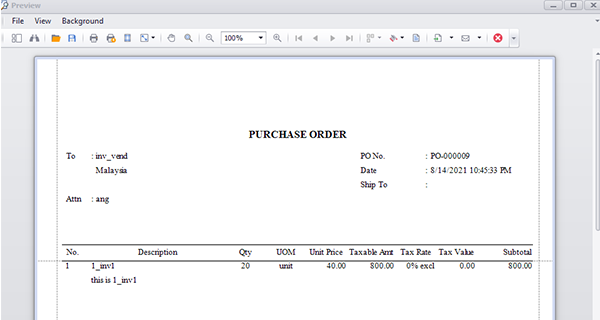

Purchase Orders:

Purchase orders are documents generated by a business to request products or services from suppliers or vendors. With BMO POS and invoicing system, businesses can create purchase orders directly within the system. These purchase orders typically include details such as the vendor’s information, requested items, quantities, prices, delivery dates, and any special terms or instructions. Once the purchase order is created, it can be sent to the supplier electronically or in print.

Purchase orders help businesses streamline their procurement process, maintain accurate records of orders placed with suppliers, and ensure timely and accurate delivery of goods or services. They also serve as a reference for inventory management and help reconcile incoming shipments with the original purchase order to ensure accuracy.

The ability to generate purchase orders within the POS and invoicing system provides businesses with a comprehensive solution to manage the entire sales and procurement cycle, helping to maintain efficient operations and strong vendor relationships.

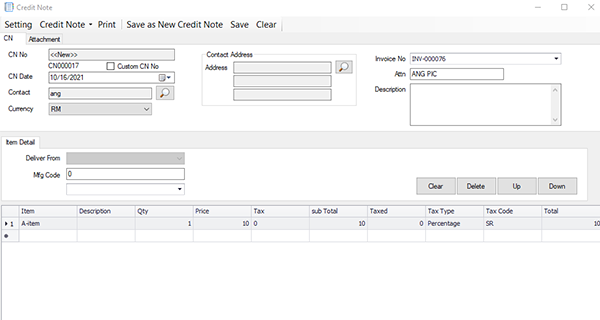

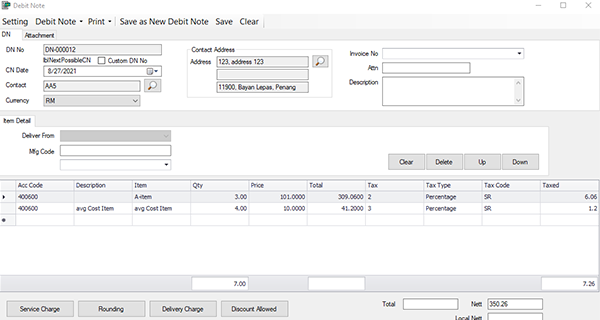

Credit Notes and Refunds:

In cases where customers return products or request refunds, credit notes are generated to document the reversal of the initial sale. The BMO POS and invoicing system can generate credit notes with relevant information such as the original sale details, the reason for the return, and the refunded amount. These documents help businesses track and manage returns, exchanges, and refunds efficiently.

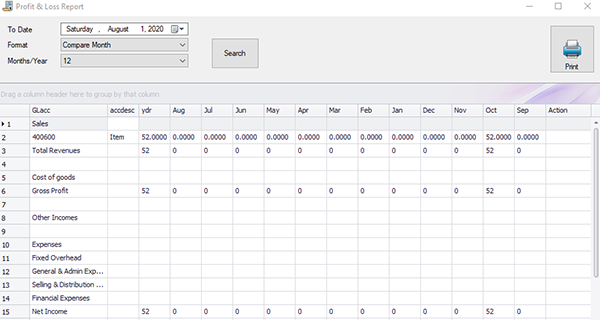

Sales Reports:

While not strictly documents for customers, sales reports are crucial for businesses to analyze their performance. A combined system can generate comprehensive sales reports that provide insights into sales trends, top-selling products, revenue by category, and other key metrics. These reports can help businesses make informed decisions regarding pricing, inventory management, and marketing strategies.

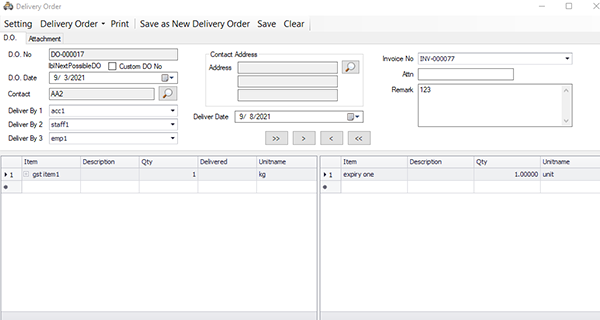

Delivery Orders:

In businesses that offer delivery services, the combined system can generate delivery orders. These documents include details such as the customer’s address, contact information, ordered items, and any special instructions. Delivery orders help ensure accurate and efficient order fulfillment, especially when coordinating with drivers or third-party logistics providers.

Account Statements:

Account statements are periodic summaries of a customer’s financial transactions with a business. In BMO POS and invoicing system, businesses can generate account statements that outline the customer’s purchases, payments, outstanding balances, and any relevant credits or adjustments. These statements help maintain transparency and facilitate timely payment reconciliation.

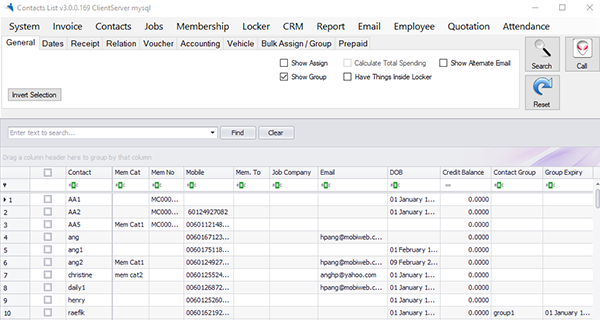

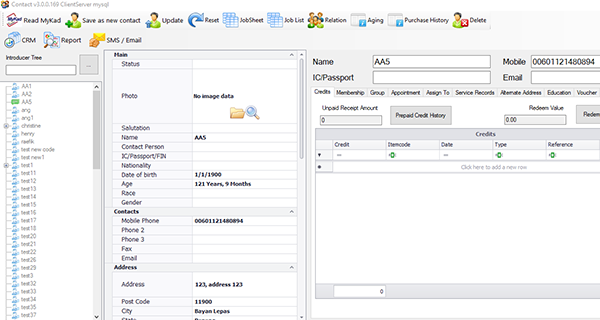

Membership System:

BMO POS Accounting membership system allows businesses to manage customer loyalty programs, memberships, or subscription-based services. With this feature, businesses can create and manage customer profiles, track purchase history, offer personalized discounts or rewards, and generate reports on customer engagement and loyalty. The membership system can be integrated with the POS, enabling seamless identification of members and automatic application of membership benefits during transactions.

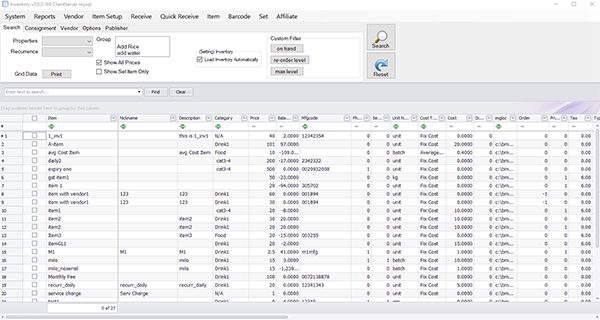

Inventory Management:

Inventory management is a crucial aspect of a POS system. It allows businesses to track stock levels, manage product variations, set up low-stock alerts, and generate reports on inventory performance. Advanced inventory features may include barcode scanning for efficient stock management, automated purchase order generation based on stock levels, and real-time inventory synchronization between physical and online stores.

Offline functionality:

One of the primary requirements for a hybrid system is the ability to work offline. This means that even without an internet connection, the POS should continue to function normally, allowing businesses to process transactions, generate receipts, and update inventory. Once an internet connection is reestablished, the system should automatically sync all the offline data with the cloud.

Cloud synchronization:

As a hybrid system, it has robust cloud synchronization capabilities. This ensures that all the data captured offline, such as sales transactions, inventory updates, and customer information, can be automatically synced to the cloud once an internet connection is available. This feature guarantees data consistency across multiple devices and provides real-time access to information from anywhere.

Inventory management:

BMO POS Accounting system offers robust inventory management features. This includes tracking stock levels, managing product variations, setting low-stock alerts, and generating reports on inventory performance. Integration with the accounting system should allow for automatic updates of inventory-related transactions.

Sales reporting and analytics:

Businesses often require detailed sales reports and analytics to gain insights into their performance. The BMO POS Accounting system provides comprehensive reporting capabilities, including sales summaries, transaction history, customer purchasing patterns, and profitability analysis. Integration with the accounting system enables seamless consolidation of financial data for accurate reporting.

Scalability and flexibility:

The BMO POS Accounting system is adaptable to the business’s specific needs and scalable to accommodate future growth. It supports multiple payment options, various hardware devices (e.g., barcode scanners, receipt printers), and customization options to tailor the system to the business’s unique requirements.

Multi-Store Management:

For businesses with multiple locations, BMO POS Accounting system supports multi-store management provides centralized control and reporting. It enables businesses to manage inventory, pricing, promotions, and customer data across all stores from a single system. This feature ensures consistency and simplifies the management of a multi-store operation.

Employee Management:

Employee management features within the BMO POS Accounting system help businesses streamline workforce operations. It includes functionalities such as employee scheduling, time and attendance tracking, performance management, and commission calculations. These features assist in optimizing staffing levels, ensuring accurate payroll processing, and monitoring employee productivity.

Ease of use and support:

User-friendly interfaces, intuitive workflows, and comprehensive support services are essential for smooth adoption and ongoing operations. The BMO POS Accounting system is easy to set up, navigate, and train staff in its usage. We provide reliable customer support and regular software updates to address any technical issues and stay up to date with evolving business needs.

BMO Accounting Software Features

BMO POS Accounting can import and export from SQL accounting software.

Invoice

Create professional recurring invoices and receive updates.

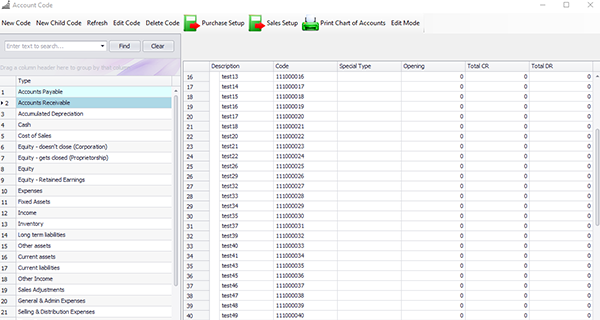

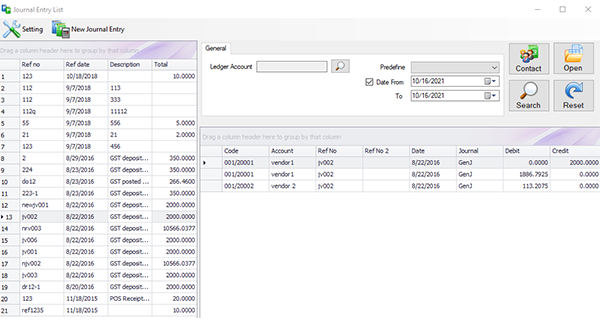

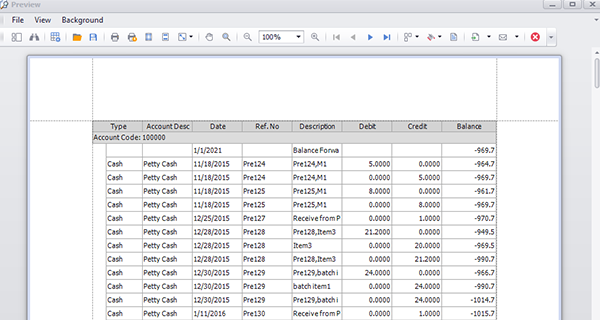

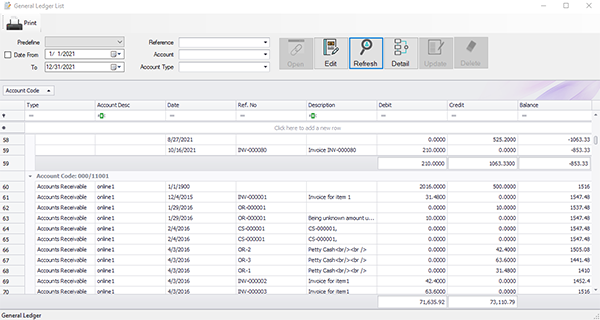

General Ledgers

Easy to manage and track your company’s accounting records.

SST & VAT Ready

Automatically calculate SST & VAT on transactions.

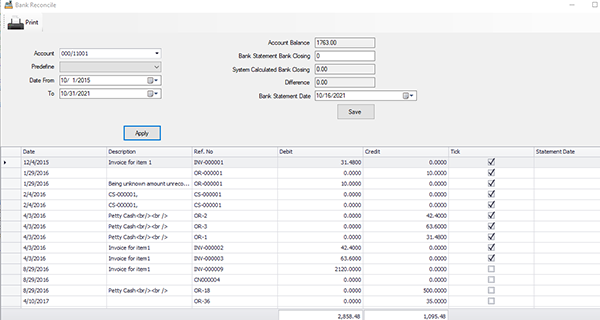

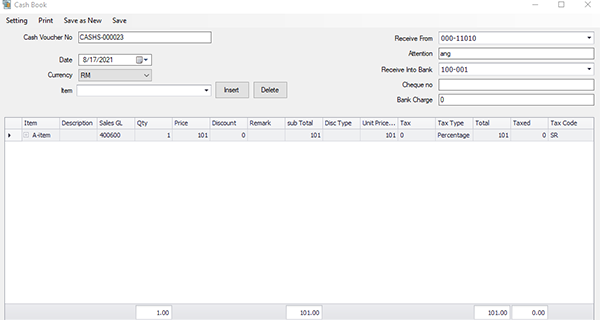

Cash Book

All cash transactions during a period are recorded.

Inventory

Inventory items speed up invoicing while tracking sales.

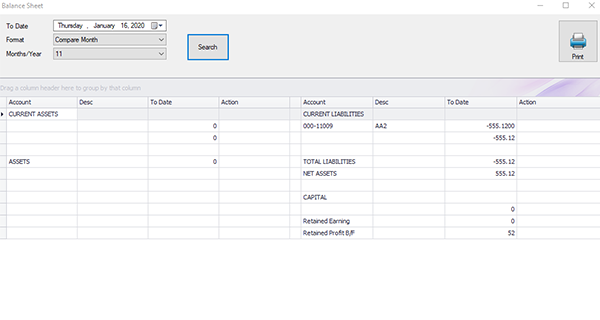

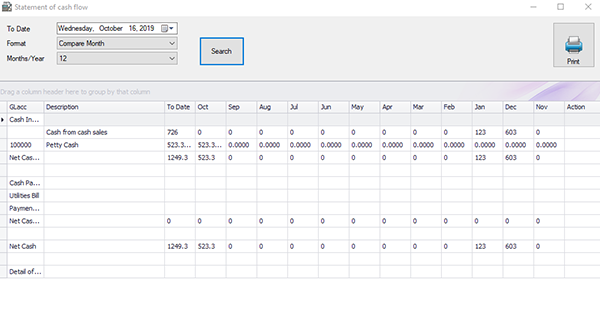

Financial Report

Balance Sheets, Income & Cash Flow Statements.

Quotation

Seller provides to a buyer to offer goods or services.

Bill Payment

Manage your cashflow by scheduling payments.

Forward Entries

Record a forward contract on the contract date.

Chart of Account

Maintain and categorized complete chart of account.

Purchase Order

Create and email custom purchase orders.

Official Receipt

Official receipt is issued by the seller to the buyer.

BMO Invoicing and Accounting

Generate professional grade business reports with dynamic re-balancing of report structure and self-tuning query optimization. Enjoy scalable cost effective deployment, increased system performance and ease of maintenance powered by a robust client-server architecture.

Sesi Demo Percuma untuk Sistem POS dengan Modul Invois

Bantu anda rekod transaksi perniagaan, mengeluarkan invois dan resit, serta urus inventori dengan mudah.

Buat temu janji dengan kami sekarang untuk sesi demo percuma. Kami akan menerangkan ciri-ciri sistem pos dengan modul invois dan tips tentang cara-cara mengunakan sistem pos kami dengan lebih cekap.